Life Insurance Calculator: Knowing the way to however the longer term

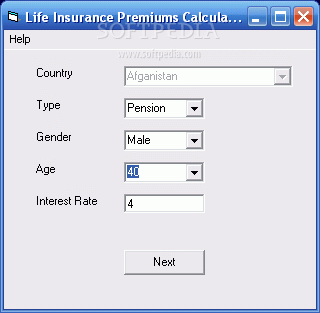

A life insurance calculator is an online tool that's meant to supply answers to queries that have to be compelled to do with life insurance annuities. plenty of individuals would wish to understand the quantity that they ought to commit for an explicit amount of your time whereas they create certain that they need regular income per month to get hold of the quantity. The calculator is additionally employed by agents who would like to encourage folks to induce a life insurance arrange. it's a handy tool for people who would like to induce annuities, maintain investment budget and assess retiring advantages. The specific amount of premium that the insured person procured the insurance company can produce a lump add over the years. If you would like to understand the quantity of your generated premiums and finish advantages, you'll use a life insurance calculator to simplify the computations. Factors just like the premium quantity, age and interest rates can have an effect on the results of the calculation.The paid premium can develop in time. it's possible that the worth of the variable annuities are going to be lost; but, the remainder are guaranteed against the potential loss. Thus, obtaining a life insurance policy could be a smart suggests that to induce a long-term money savings. As you utilize the calculator, you may wish to properly enter the variable so as to get the foremost favorable outcome within the tool. The calculator may assess the annual rate of interest and also the variety of years that you simply expect the advantages. no matter data you provided, it's possible to be converted at any time to work out whether or not the end result matches your desires.

It is terribly straightforward to use the calculator and it takes simply some minutes to complete the calculations. The tool can give you with an estimate of the quantity of insurance that you simply would like based mostly on your future expenses, monthly living expenses, assets and outstanding debts.

If you would like to buy a life insurance annuity, it's necessary that you simply access this calculator on-line. it's useful for the common individual who might not notice it straightforward to understand on some connected terms. There are plenty of things that may happen within the future that you simply won't apprehend thus it's vital to induce a life insurance policy. With the help of the calculator and a money advisor, saving for your future are going to be easier to try to to.